The Future of Field Service Technology

Benchmarking the Cutting Edge in Service Technology

Table of Contents

- Executive Summary

- Key Findings

- Research Analysis

-

- The Service Industry Is At An Inflection Point

- Meeting The Challenges Of Cutting-Edge Technology Adoption

- The Role Of Big Data In Enabling Innovation

- Where The Service Industry Is Integrating Key Technologies Today

- The Near-Future Of Service

- Key Recommendations

- Appendices

-

- Appendix A: Methodology

- Appendix B: Related Research

- About Us

-

- Field Service

- Blitzz

- IFS

- Verizon Connect

- WBR Insights

Executive Summary

The service industry is being driven in exciting new directions by the development and integration of a range of new technologies. Cutting edge technology is helping to drive a service paradigm of greater visibility, efficiency, and profitability with maximized device uptime. The technologies supporting these developments range from the introduction of service automation and AI, to new learning tools and augmented reality solutions that allow techs to do more in the field.

The ability to capture data from the field is fundamental to the technological transformations underway across the industry. Today, three-quarters of service organizations have rolled out sensor-equipped products, creating a steady ow of Big Data that can be used to fuel advanced analytics and the integration of solutions leveraging AI and machine learning. That said, data collection through sensors is not the only way in which the physical world is being influenced by new solutions.

Tools such as mobile knowledge management, fleet management, safety apps, and mobile workforce management are allowing technicians and their vehicles to contribute to and utilize a wealth of data that is now available to support them in the field on demand. Field service managers gain insights on how to build efficiency into scheduling as well as the ability

to weigh in on problems encountered in the field, then catalog that knowledge to aid the organization in the future. Technicians are able to leverage tools that break down and crowd-source issues for them, boosting first-time fix rates and allowing hiring managers to focus on the development of soft-skills. These trends are contributing to a service industry workforce that is able to get the job done while developing important relationships with customers on behalf of their brands.

While service organizations lay frameworks of sensors and solutions to capture data across every facet of their organization, AI and machine learning represent the next steps that organizations are taking to leverage the value of the information they are capturing. Their ultimate goal is to transition from service models based around a reactive, break-fix model to one that achieves near constant uptime through the integration of autonomous repairs. While a fully autonomous service strategy is rare today, our research indicates that the pace of change will see a significant shift in service industry standards within the next 24 months. Read on to see what your peers in service leadership are working on today that will define the near future of service.

Key Findings

Within the next 24 months, major changes to the service industry will play out. A strong movement towards autonomous service models will be supported by a host of developing technologies. While autonomous strategies are most common today among enterprise level organizations, these strategies are being worked on by organizations of all sizes.

The collection and usage of Big Data is one of the key developments within the market supporting other advanced capabilities, with one of the most significant being the introduction of AI that respondents predict will be a major factor within the next two years.

The most common barriers in the way of new technology adoption are led by difficulty integrating new solutions into a legacy environment. This elevates the concept of digital transformation and adaptation to the prevalence of the cloud a major focus for service organizations looking to position themselves for the future.

HOW WILL YOU MEET THE SERVITIZATION CHALLENGE?

By Tom DeVroy, Senior Product Evangelist, North America, IFS

The data in this WBR research is clear. The servitization megatrend is upon us. What we see in this study is product, or asset-driven companies adding incremental revenue streams from both products and service revenues through new solution offerings enabled through servitization.

DEMAND, OPPORTUNITY AND TECHNOLOGY

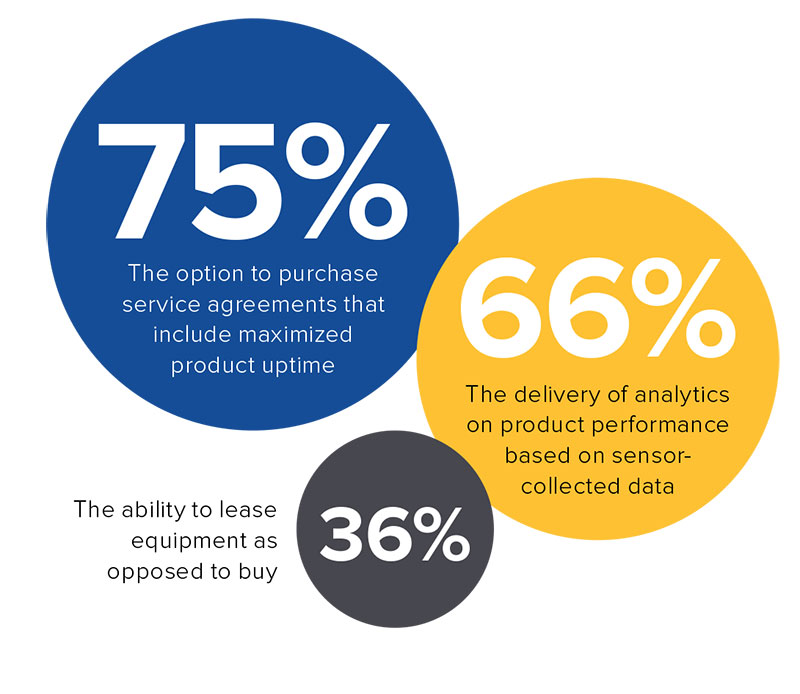

Like many trends affecting business-to-business commerce, this trend is driven in large part by customer demand. In the WBR data, 75 percent of respondents said they feel the need to offer innovative service agreements, which in many cases guarantee product availability. Customers are also demanding performance data from the equipment they buy, and 66 percent of respondents cited this in the study. A significant minority of 36 percent also said their customers want to lease their products rather than buy, which also carries aftermarket requirements not present with an outright sale.

From our own experience at IFS, we also find our customers see servitization as a remedy for uneven year-over-year business revenues and shrinking margins.

Aftermarket services may also make the customer more dependent, as they push off important value-added services like maintenance, operation and asset lifecycle management onto the supplier. This enables strong customer engagement and may insulate the vendor from competitors. It also enables a vendor to access deep insights on how their customers are using their products, which can in turn drive a consultative selling process. A recent report from McKinsey suggests that while margins on new product sales are roughly 10 percent on average, aftermarket service margins approach 25 percent or better.

Enabling technologies are also making servitization more feasible. The internet of things (IoT) is enabling companies to sensor products they sell and use the resulting data streams to automate everything from re-order to dispatch of a service technician.

But even with sensors capturing data from equipment in the field, actually realizing the revenue potential of servitization poses some significant management and enterprise software problems. Executives at product-focused companies must be able to plan around not only the product lifecycle but the service cost and revenue cycle. When the service agreement is sold, a company will be committing to delivery against contract terms that they could make or lose money for years.

IFS STUDY SHOWS ADVANCING SERVITIZATION

A 2018 study by IFS delivers insights into the current extent of servitization, leaving no doubt that some product-oriented companies are better positioned to capitalize on this trend than others.

Among respondents to the IFS study, the majority had some type of aftermarket revenue stream, even if that revenue stemmed strictly from aftermarket parts sales. The smallest segment was those who had servitized completely—essentially doing away with product revenue and charging for the product or asset based duty cycle, hours of usage, availability or some other metric.

- 38 percent of respondents sold only products, with no aftermarket or other service revenues.

- 19 percent sold products and some aftermarket service parts.

- 15 percent sold products and aftermarket field service through break-fix repair.

- 16 percent sold planned maintenance contracts with service level agreements (SLAs).

Only 4 percent of respondents reported full servitization—selling products on a subscription rather than a discrete item through power-by-the-hour, fee-for-usage or revenue sharing agreements.

LET IFS HELP

At IFS, we offer the most complete field service management solution on the market, encompassing not just the tools for and dispatch of the technician but important back office functions like reverse logistics, warranty/contract management, advanced inventory management, IoT data capture and AI-driven customer service. Let us know how IFS can help.

Let us know how we can help by visiting us at IFSworld.com.

All About the Advantages That Our System Has to Offer

ALLOW YOUR CUSTOMERS TO REACH OUT OVER VIDEO & CHAT

- Easily shift to a personalized customer-centric work ow

- Remotely see their problems to be better prepared before visit

- Have a centralized channel for all customer communication

- Reduce truck rolls, time to resolve, boost rst time x it rates & NPS

- Deploy to your customer with or without an app at their end

- Great for retail as well

ALLOW TECH - REMOTE EXPERT COLLABORATION

- Experts can guide techs remotely with live video, AR & chat

- Train, troubleshoot over desktops, mobile & smart glasses

- Reduce warranty and casualty costs while empowering techs

- Record remote support video sessions to add to knowledge library

- Automatically route techs to the right experts or groups of experts

USE AR & POWERFUL COLLABORATION TO BOOST PRODUCTIVTY

- Chat and interactively draw on images and videos

- Point your mobile device camera and see part names & details (AR)

- Automate your existing videos to provide step by step instructions to techs as they work hands free, wearing smart glasses

- Add relevant experts to the collaboration at any time

- Exchange documents and videos

- Predict technician's needs and provide helpful tips & resources prior to visit to customer's site (Predictive Support)

- Get insightful support analytics

- Evaluate and reward techs contributing to tribal knowldge

Available for: ![]()

Learn more about Blitzz at

www.blitzz.co

Workforce Management

Optimize operations with

workforce management

Businesses may have systems to manage operations like work orders, accounting and even emails, but what about people? After all, depending on the industry, businesses can spend anywhere from 40 to 80 percent of their gross revenue on employee bene ts and salaries, according to the worldwide organization Society for Human Resource Management1. In fact, salaries alone can make up 18 to 52 percent of an operating budget.

If employees are our biggest expenditure, why not ensure they are operating at the most efficient level possible? Enter workforce management systems, the solution many organizations are utilizing to increase productivity and planning while saving time and money.

Workforce management is a broad term used to cover a variety of tasks from performance management to employee forecasting, with business leaders examining the results for better decision making. For example, a eld service workforce management solution could determine future demand, thus forecasting the number of work orders expected during a company’s busy season. From there, the software could help optimize employee schedules and even the amount of parts and vehicles needed to execute the jobs, assigning work orders within predetermined work zones

This streamlined approach to how leadership manages its workforce would help increase productivity, saving time, and ultimately saving the business money. That’s not to mention the

customers’ satisfaction as employees can address more jobs, do so on time and arrive with a deluge of near real-time information.

However, workforce management solutions aren’t only a win-win for business leaders and customers, but also for employee morale. Rather than burn out the workforce by turning the productivity dial to the max, the new level of transparency and engagement has also shown to increase employee satisfaction.

As businesses look to increase spend on IT services and jump deeper into digital operations, workforce management solutions are widely considered to be the top on the list of priorities.

Percentage of small businesses that will increase their budgets for productivity apps over the next two years.2

Learn more at verizonconnect.com or call 866.844.2235

©2018 Verizon. All rights reserved. https://www.shrm.org/ResourcesAndTools/tools-and-samples/hr-qa/Pages/default.aspx https://a.sfdcstatic.com/content/dam/www/ocms-backup/assets/pdf/misc/benchmarks-small-business.pdf

The Service Industry Is At An In Inflection Point

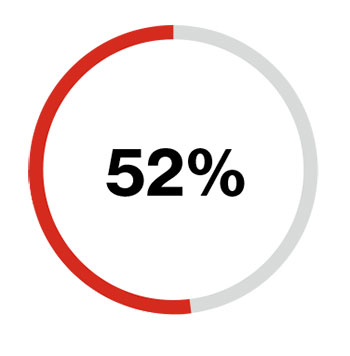

Where is your current service model on the following scale? Where do you anticipate it will be in the next 12 months? In the next 24 Months?

Within the next 2 years, service models are predicted to complete a shift away from a reactive, break- x approach to preemptive or even autonomous service strategy.

Standards in the service industry are rapidly developing as technology drives innovations in the delivery of uptime.

Today, 60% of respondents are managing either a reactive model, or have advanced to a proactive service model that is slightly stronger at maintaining uptime. Only 8% of respondents today have managed to implement a strategy that is fully autonomous. Of this group the majority are large organizations, as 27% of enterprise respondents indicated they have made autonomous service part of their current strategy. That stated, while only 7% of the mid market has achieved this, within the next 24 months, 80% state that they will have developed the ability to operate using this strategy. SMBs predicted adoption levels double in a year, and then that number doubles again to the point that 76% predict they will also be able to support an autonomous service strategy within the next 24 months. Almost half of respondents will have brought AI, machine learning, and Big Data to bear for them to the point that their equipment in the eld will be able to perform self-service on a preemptive basis. The implications of a service industry where nearly one in every two organizations will have adopted an autonomous service model are huge.

Do you feel increased pressure on the part of your customers for the following features?

Respondents are developing their capabilities partly in response to growing pressures from their customers to provide more features.

Tech adoption and the evolution of service models are partially in response to pressures coming from end-users themselves. Within certain industries, the support of maximized product uptime has already become a standard feature that can be considered table stakes when o ering a service agreement. The medical device industry is a good example of an industry where the lifesaving nature of solutions in the eld require them to be up and running with virtually no down time. This level of service, as well as the delivery of analytics that are useful to the end- user will become increasingly common in coming years, though laying the groundwork to support them is already underway within the broader service industry. Early adopters may still be able to leverage these features as di erentiators, though that advantage may not last more than a few years time.

Meeting The Challenges Of Cutting-Edge Technology Adoption

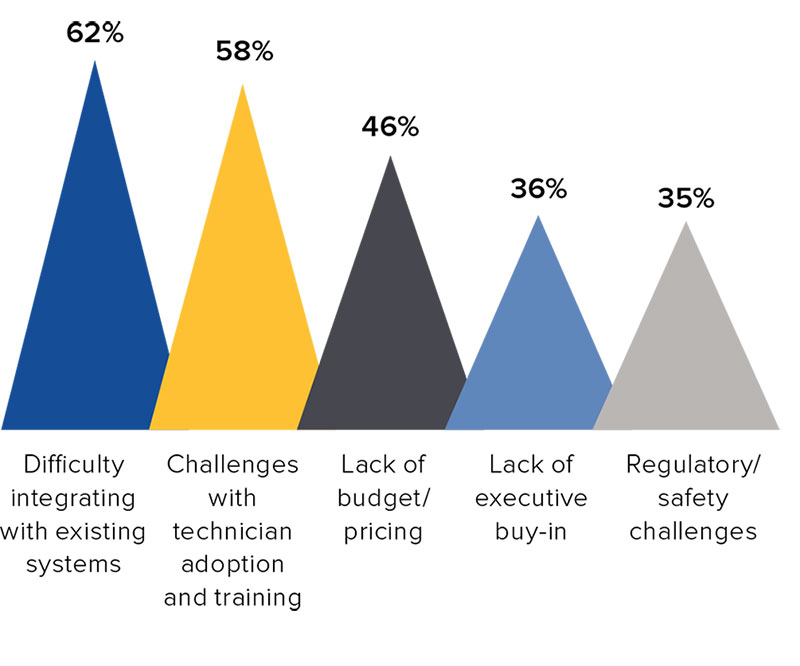

What are the most signi cant challenges you face when integrating cutting-edge technology into your service strategy?

Making new solutions work in a legacy environment is the most common challenge facing respondents who are attempting to integrate cutting-edge technology.

The importance of supporting a service organization with the most effective technology cannot be understated, but integrating those new solutions into legacy environments is often easier said than done. The size of a deployment can also add complexity; 64% of enterprise struggle with integrating their new tech with their legacy environments, 12% more than SMBs (52%).

Over half of respondents also face challenges managing technician adoption and training on the new solutions that they are presented with.

Budget and pricing are a fairly common challenge, and go hand in hand with creating executive buy-in. It’s common for service organizations to encounter challenges freeing up budget to invest in cutting edge technologies. In order to win budget, the value of cutting edge tools must be communicated to business leadership; without creating a clear roadmap for how investments will contribute value

to the organization, it’s not likely that key-stakeholders will move forward. In particular, product-centric organizations that have not yet managed to turn service into a pro t center struggle with obtaining budget resources to invest further into new technology. Many will choose to wait for others in their industry to develop leading-edge capabilities before following in their wake, though doing so loses them the first-mover advantage and risk falling behind the pack. In the case of creating buy-in, larger organizations seem to have the advantage. While 55% of SMBs struggle with executive buy-in and 40% of the mid market have this same challenge, only 29% of Enterprise respondents reported that buy-in was among their main difficulties.

Finally, just over a third of respondents are being challenged to meet regulatory requirements for safety and compliance. One of the most signi cant questions raised by movements towards constantly connected devices, AI integration, and the IoT, are concerns around data ownership and security. As a wealth of data is created and analyzed, new avenues of misuse are also opened. With new regulations for the safeguarding of customer data in place in the form of the GDPR and other international legislation, major questions around the security of new technology will need to be addressed in the years to come.

The Role Of Big Data in Enabling Innovation

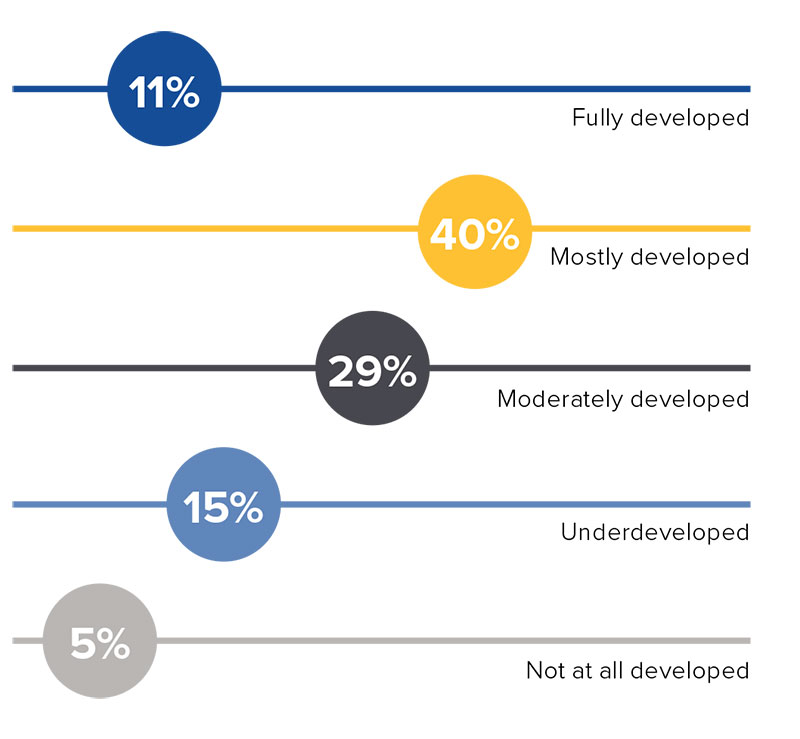

Please rate your current ability to utilize Big Data to support your service operation (e.g. preventative maintenance, etc.) on a scale of 1-5, with 1 being fully developed, and 5 being not at all developed.

Changes in the service industry fueled by Big Data are already making themselves felt. Today, the majority of service executives are already capturing Big Data and developing the means to leverage it as a powerful force for organizational change.

One of the most powerful calls towards cutting-edge technology adoption is the potential that Big Data analytics holds for unlocking deeper insights on product functionality, customer usage, and the health of equipment down to a component level. Much of the cutting edge technology and solutions that the service industry is examining is focused on consolidating and gaining productive views over the information that they are already collecting. In order to begin to integrate machine learning and AI, a foundation of Big Data capture is necessary. The majority of the service industry recognizes this fact and has laid the groundwork for Big Data capture in earnest. The farther a service organization gets on their journey, the greater the bene ts they can expect; of those who report that they have fully developed adoption of Big Data, 60% have also achieved an autonomous service strategy.

Where The Service Industry Is Integrating Key Technologies Today

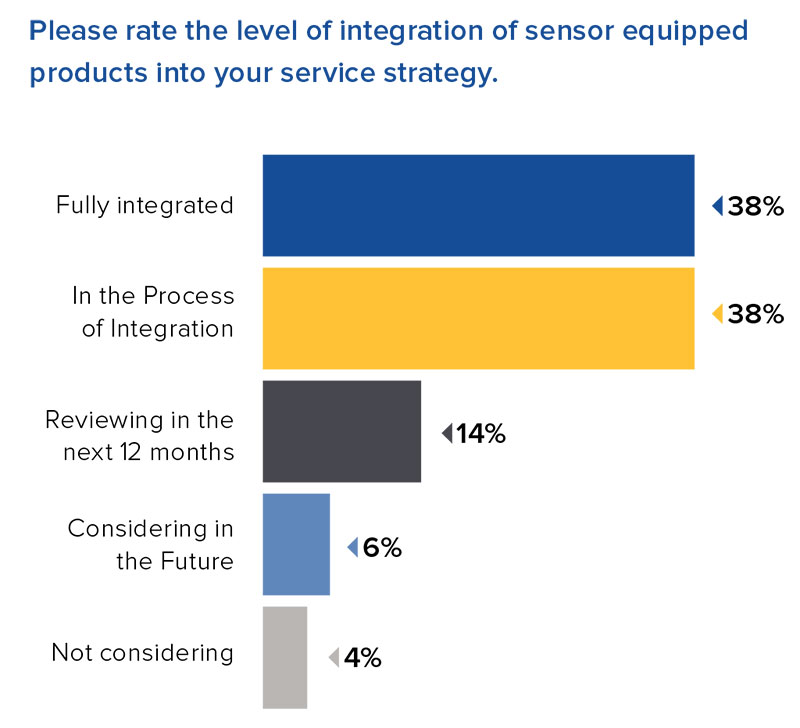

Rolling out sensor-equipped products is a precursor to Big Data capture, making it a fundamental part of digital transformations within the service industry.

Three-quarters of service organizations have either rolled out sensor equipped products, or are in the process of doing so. In many ways the ability to collect data from products in the eld can be considered a prerequisite for future-facing strategy within the service industry, as the data that they capture forms the foundation for Big Data capture and analysis.

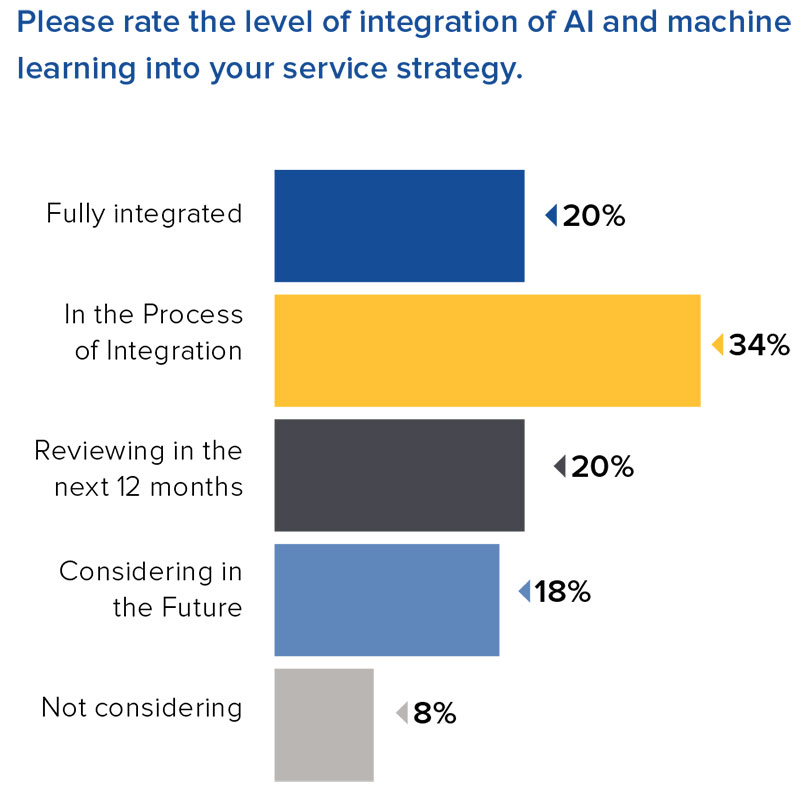

While it is now relatively common for service organizations to have rolled out sensor equipped products, the ability to use the information they capture to support AI is less well developed. AI integration is in place within 24% of enterprise organizations, and 10% of SMB size. Their peers in the mid-market have generally yet to catch up with no respondents indicating AI was in place today, though 20% are currently in the process of integrating AI solutions.

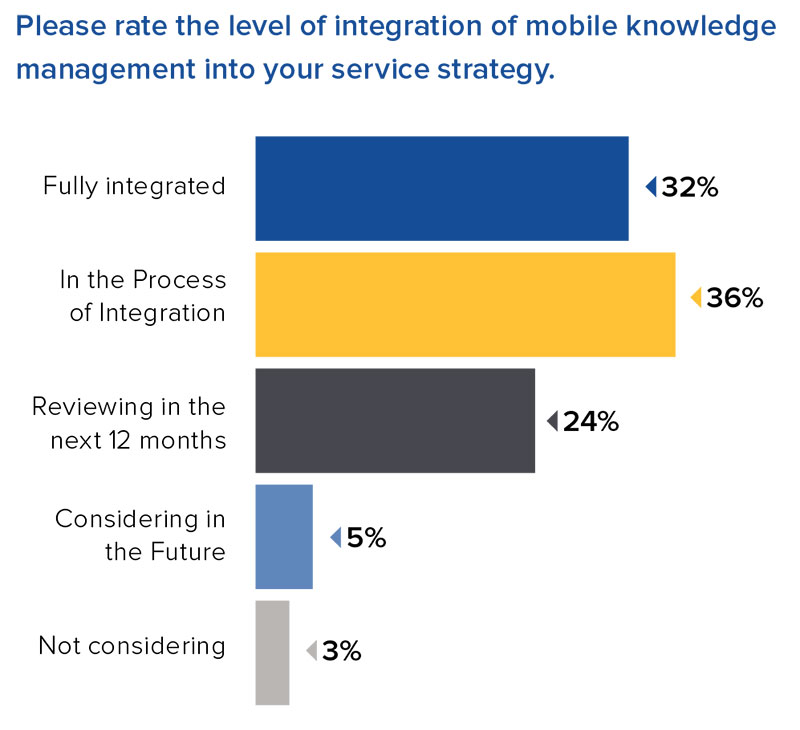

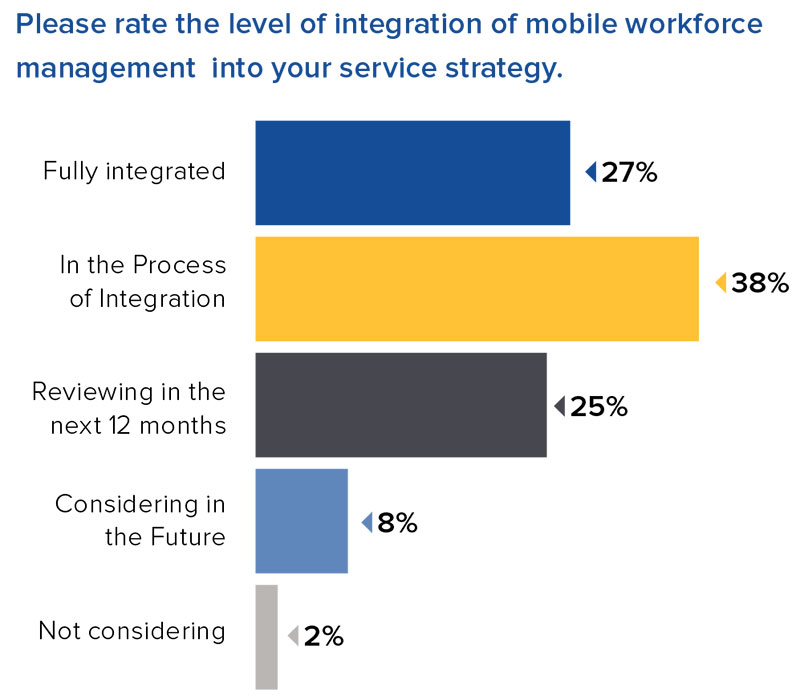

Supporting a technician force in the eld through mobile workforce and knowledge management tools are strategies that over half of service organizations have either implemented or are in the process of implementing today.

In the same way that sensor-equipped products are providing the means for deployed devices to share information with a service management team directly from the field, the increasing prevalence of connected devices are allowing technician forces to access a wealth of organizational support when responding to a service call or while performing routine scheduled maintenance. Mobile workforce management solutions can assist with scheduling technicians for optimal efficiency, providing precise directions while ensuring that the full workforce is operating with peak productivity.

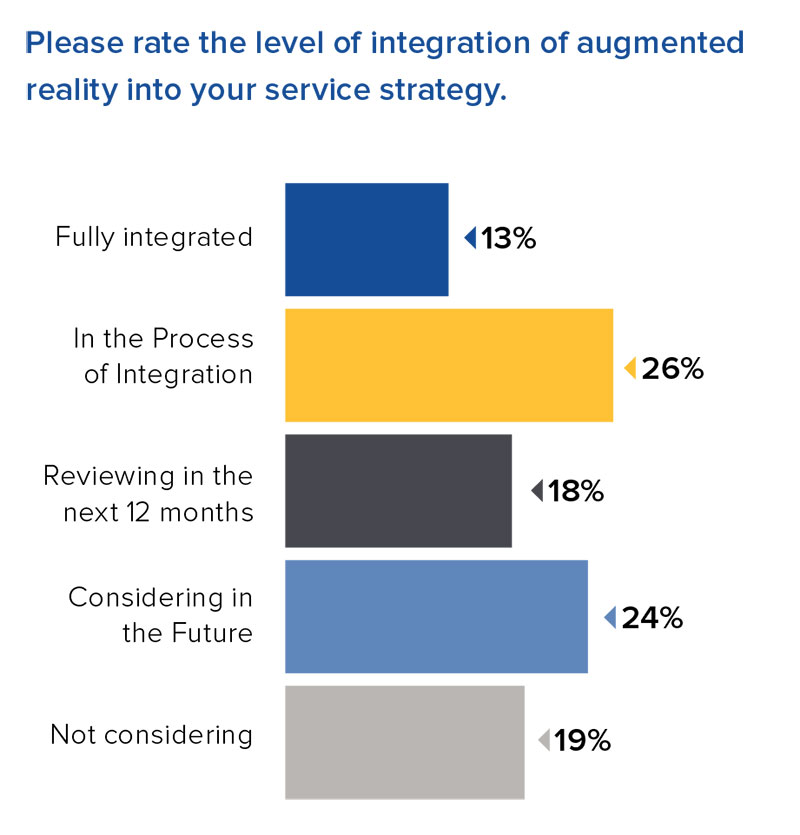

Mobile knowledge management seeks to bring the full knowledge resources of the organization to technicians in the field through apps or portals that can be accessed to increase the efficiency of field operations. Whether this includes access to tutorials or manuals, the logging of contract information or signatures, or comparing newly captured data to historical trends, the applications for KMS (knowledge management systems) are broad and potentially transformative. Features such as live video streaming that already assist in remote diagnostic assistance can be combined with developing technology capabilities such as augmented reality to more clearly illustrate the solutions to a problem in the eld that might otherwise have been impossible for a single technician to solve.

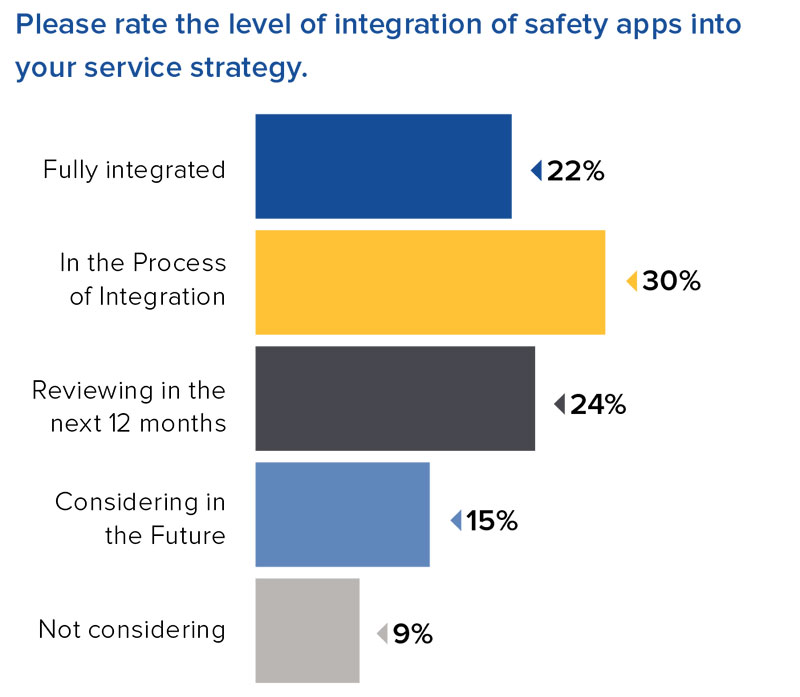

Safety apps can provide easy to use checklists that assist with maintaining compliance standards while on-site and minimizing the likelihood of future part failures or other accidents. These solutions provide yet another tool in the field for service technicians to cross-check their efforts with established best practices within the organization, helping to reduce the need for repeat visits and ensure that safety standards are easy to understand and uphold, directly combatting physical and reputational damage.

In a mobile world, the very nature of the service organization is able to transform. Mobile service enablement solutions are increasingly facilitating a new approach to hiring within service organizations. As technology provides a cushion of readily accessible knowledge to technicians in the field, service managers can prioritize the development of “soft skills” within the workforce, allowing the development of a stronger customer facing experience that can help contribute to customer loyalty and satisfaction.

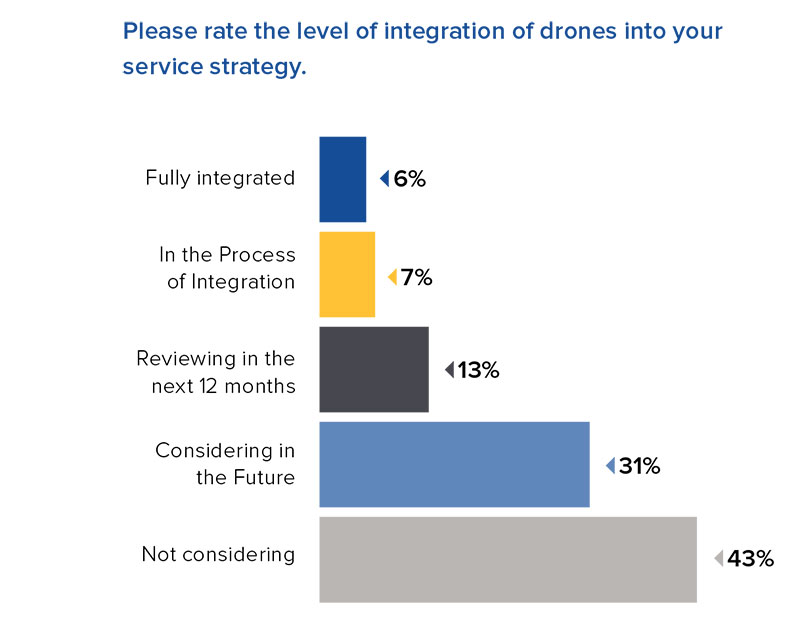

The use of drones and augmented reality solutions are extending the physical and digital frontiers of service.

While these technologies are very different in their applications, both drones and augmented reality have the potential to heighten the reach and capabilities of service teams. While relatively fewer organizations have succeeded in rolling out these capabilities today, their ability to fill critical niche demands within a service organization holds major potential for their future use.

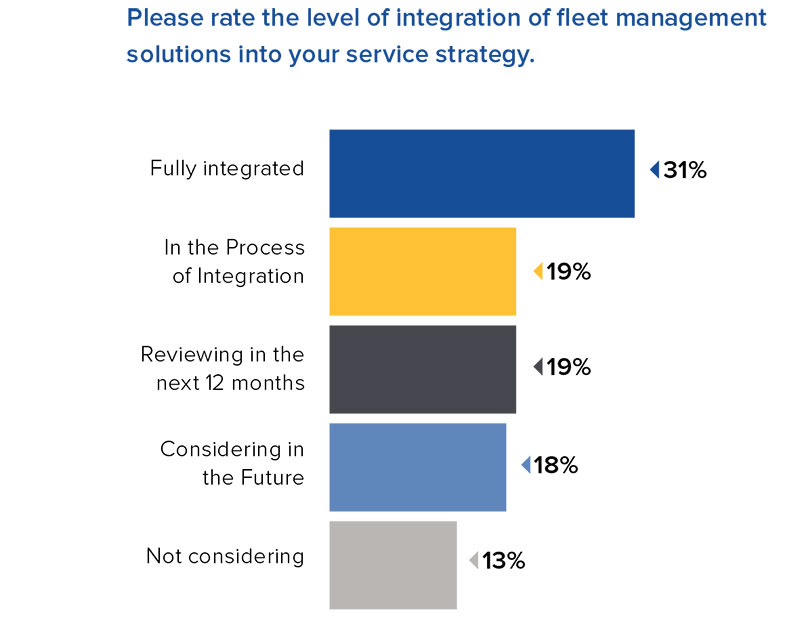

Gaining information on the deployment and functionality across a eet allows service managers to use their resources more efficiently to enable specific outcomes.

In an advanced service organization, visibility begets efficiency. Fleet management solutions can help pinpoint the location and condition of a vehicle, the status of a driver, and even help determine the ROI associated with each vehicle within the eet. This type of information is invaluable when working to ensure the profitability of a service operation. The data that is captured by these solutions can also provide a strong foundation for more advanced analytics and the application of machine learning or AI, giving back even more to the business through the delivery of actionable insights. Ultimately, fleet management solutions contribute to a more cost-efficient workforce that is able to get more done within a more concise amount of time, helping service organizations focus on developing a strong and reliable customer experience.

Augmented reality is a growing area of service technology with a broad range of potential applications. By projecting digital elements over physical reality, objectives such as displaying an HUD (heads-up display), pinpointing the correct location for a replacement part, or giving a remote technician an inside look into a machine in the field are able to be accomplished.

The Near-Future Of Service

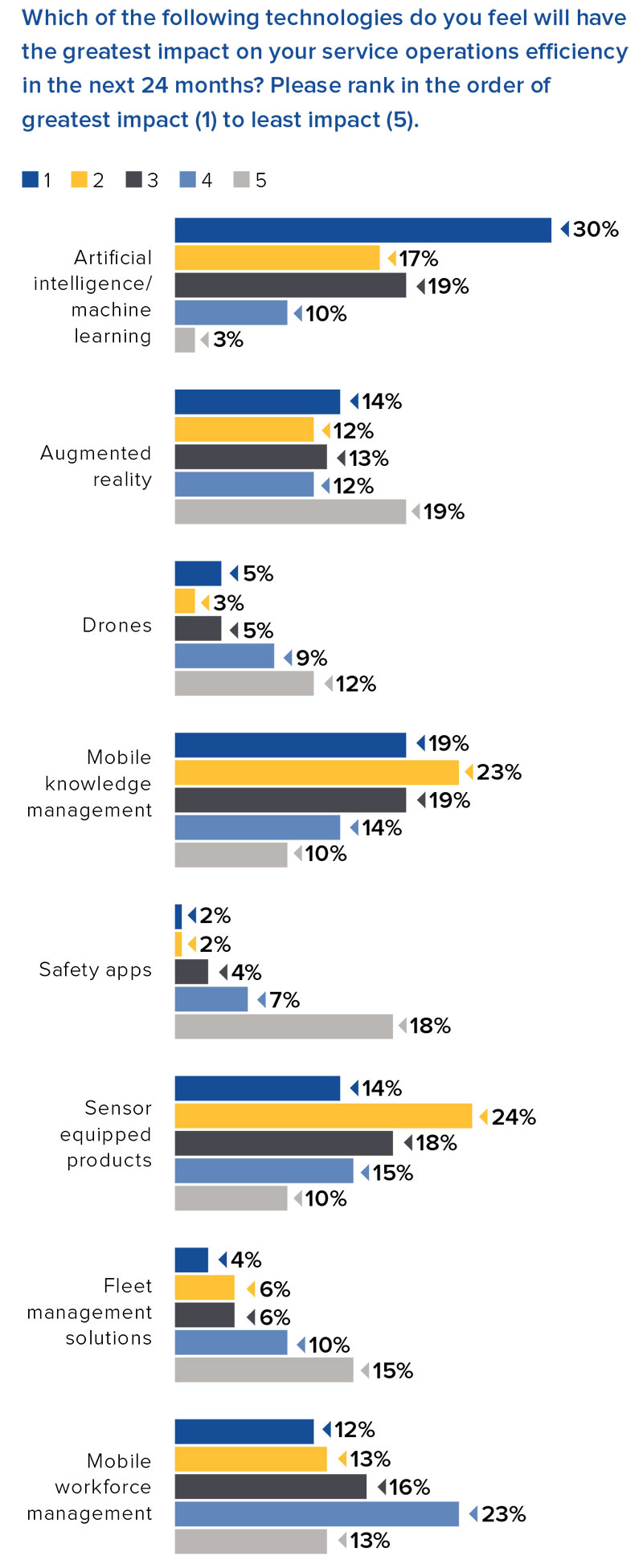

The near-future of service will be de ned by the impact of growing AI adoption along with the constant availability of information.

More than any other emerging technology, AI stands out as having a significant impact on over 50% of service organizations within the next 24 months. This is particularly significant given the fact that all the technologies listed have the potential to be hugely impactful, with strong showings in mobile knowledge management indicating that constant connectivity will be on of the hallmarks of the technicians of the near future.

The next 24 months see the impact of mobile knowledge management solutions and other mobile management tools impacting the industry. Sensor equipped products are continuing to make their presence felt as they become ubiquitous across all service segments, and their already high adoption is likely what holds them back from having a greater predicted impact as their presence in the market is already creating significant transformative effects.

Ultimately, no single solution will be fully responsible for the transformation of the service industry in the short term. Rather, service executives must develop comprehensive strategies to digitally transform their service operations using the full breadth of emerging technologies available to them. While navigating these new territories with the considerations of cost and reconciling legacy solutions will not be easy, the end result will be continued survival in a service industry characterized by imminent change.

Key Recommendations

1. Develop your Big Data infrastructure and collection methods to support more advanced technology integrations. Sensor deployment and Big Data management are two of the keystones for up to date technology strategy.

2. Without undergoing digital transformation and the integration of mobile tools, it’s unlikely that a service operation will be able to compete within the span of 24 months. Provide your technicians with the means to access safety and learning tools, while monitoring their scheduling and performance remotely.

3. Create a plan that prioritizes the features that your end users want and expect the most. In particular, features that support stronger reporting on device usage and optimization are in demand, along with maximized uptime. This fact points to the eventual integration of AI to support a higher degree of device analysis and the automation of service features to help maintain constant performance.

Appendix A:

Methodology

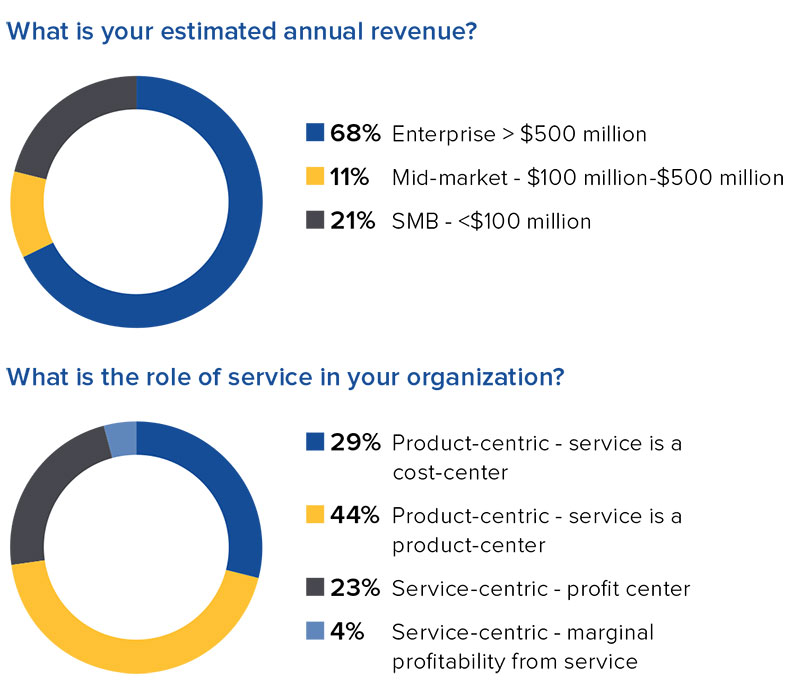

The results analyzed in this report were gathered from a digital benchmarking survey delivered to executives across the service industry who opted in to Field Service event communications. 136 executives responded to the survey.

Appendix B:

Related Research

About Us

Field Service is your one-stop shop for all things service and support; an event where inspiration meets innovation; socializing meets ROI. Experience tons of sessions, interactive learning, guest speakers and keynotes, all in beautiful Palm Springs.

Whatever your pain point, we’ve got you covered. Our topics cover every area impacting your business – service revenue, preventative services, connected devices and IoT, customer experience, remote diagnostics, global service, parts management, knowledge management, training and development, workforce management, mobility, help desk support, and a lot more.

Where else can you network like you can at Field Service? Nowhere. Join our performance workshops, infamous evening reception, interactive working groups, 20 years of service club, Women in service meet-up, and much more. With more than a days worth of networking, you’ll come for the inspiration, but stay for the fun.

IFS develops and delivers enterprise software for customers around the world who manufacture and distribute goods, maintain assets, and manage service-focused operations. The industry expertise of our people and solutions, together with commitment to our customers, has made us a recognized leader and the most recommended supplier in our sector. Our team of 3,500 employees supports more than 10,000 customers worldwide from a network of local o ces and through our growing ecosystem of partners.

For more information, visit: IFSworld.com

We are a team of writers, researchers, and marketers who are passionate about creating exceptional custom content. WBR Insights connects solution providers to their targeted communities through custom research reports, engaged webinars, and other marketing solutions.

Learn more at www.wbrinsights.com

Blitzz delivers value because customer & field support teams want nothing better than reducing truck rolls, casualty and warranty costs while driving up first-time fix-it-rates, productivity, efficiency and NPS scores. Each collaborative event from Blitzz does exactly that. Blitzz is a video powered, enterprise Field service platform that quickly becomes the smart, system of record for all collaborative events between Field techs, HQ support and end users of physical equipment in the field. Collaborative events that Blitzz enables through its mobile, web and smart glasses technologies are messaging, live interactive video and AR. Machine learning from each collaborative event, together with data pulled in from Field service management systems (FSMS) & CRMs that Blitzz integrates with, drives predictive support. This learning empowers the support and Field techs to preempt getting stuck, be better prepared, and diagnose, install, troubleshoot, repair and provide exceptional interactive support, keeping customers happy while creating a fantastic ever growing library of easily accessible, tribal knowledge through every technician's phone/tablet, smart glasses or desktop. Their integrations also help launch Blitzz from within FSMS as well. Our analytics empower support team VPs with the insight to optimize work ows and costs. While FSMS typically provide a web-first approach to scheduling, dispatching, invoicing and billing, we focus on the ever important but missing mobile first collaborative events to greatly augment such work flows. IOT connectivity through Blitzz delivers a complete and powerful remote troubleshooting platform.

Our full suite of industry-defining solutions and services put innovation, automation and connected data to work for customers and help them be safer, more efficient and more productive. With more than 3,500 dedicated employees in 15 countries, we deliver leading mobile technology platforms and solutions.